Customer Services

Copyright © 2025 Desertcart Holdings Limited

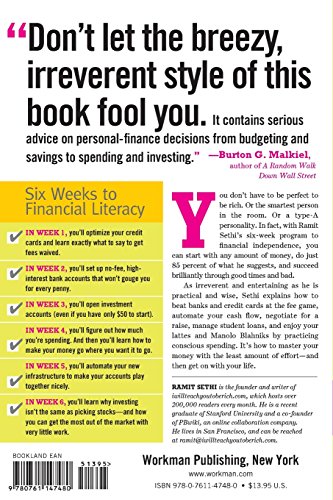

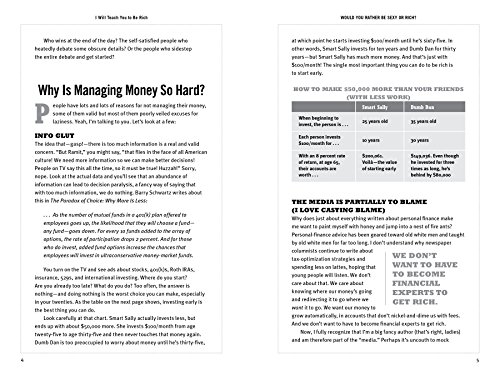

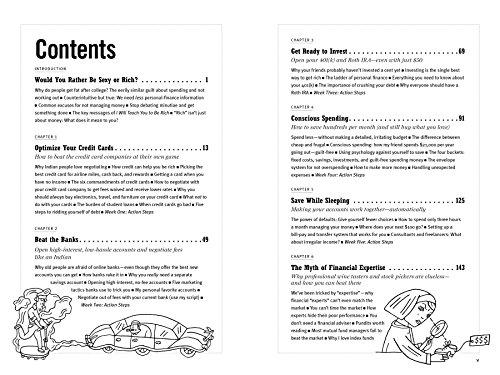

I Will Teach You To Be Rich [Sethi, Ramit] on desertcart.com. *FREE* shipping on qualifying offers. I Will Teach You To Be Rich Review: A Great Personal Finance Book - I find it surprising that many other reviewers gave this book a lower rating because of its title. This book doesn't claim to be anything other than a personal finance book, and getting your personal finances in order and having the proper framework for thinking about finances is the first step to accumulating wealth. I'm reading Orman's "Young, Broke, and Fabulous" right now for example, and this book is MUCH better. Here's why its different: 1) Its organization is well thought out. The author lays out that the steps in a clear manner how one might TRANSITION from being somewhat disorganized about finances to being extremely efficient. The book is structured to tackle bank accounts and credit cards first, then moves to setting up the retirement accounts, then automating the payments of expenses and routing money to retirement accounts, and finally tackles investing and setting aside money for the big ticket purchases. 2) The content of the individual sections is of extremely high quality. What do I mean by this? In the bank account section Sethi suggests moving to an interest checking account (many checking accounts don't pay you interest). He suggests moving savings to an online savings account that offers a high interest rate (double to triple what I got at Citibank). He also suggests keeping no more than is absolutely necessary in the checking account, so as to maximize the high interest savings account. For me personally, I used to keep large amounts in my checking to avoid Citibank's fees (which I also found out would be waived at many other banks). Basically through a few changes with my accounts, I'll probably be making hundreds of dollars this year on interest. As the balances within the accounts grow, that will change to thousands more on interest. This sort of extremely good, specific, actionable advice is sprinkled all over the book. The credit card section also has a lot of great actionable advice on simple ways to improve your FICO score. 3) In addition to teaching you how to save money, the book also teaches you how to save TIME. A huge part of this book teaches you a method for automating your accounts so that your money gets routed to retirement accounts, savings accounts, and paying bills and credit cards flawlessly on time, without any effort on your part. This is probably the most useful section of the entire book. I've definitely wasted a lot of time in the past individually mailing checks, and then later individually paying bills online... The system as a whole is powerful, and will save me time as I begin to implement it. ***My one criticism of this book is the section on investing. While I think Sethi is correct about everything else in the book, he is wrong to tell individuals never to pick their own stocks. His advice on index funds and lifecycle funds is good for most people, but its not good for everyone. Some people SHOULD pick their own stocks. I also don't agree with Sethi's take on asset allocation. He suggests that an investor should begin shifting from stocks to bonds as he/she gets older. I personally believe that bonds should be bought or sold depending on whether stocks are in a bull market or bear market cycle. Despite these investing criticisms, I still gave this book 5 stars, because for 80% of people it doesn't matter. They SHOULD just stick their money in index funds or lifecycle funds. The other 20% of people who want to pick stocks would be well served by reading a book devoted solely to investing. If you are interested in picking stocks, read The Intelligent Investor by Ben Graham. Its the single greatest book on investing, as stated by Warren Buffet. Review: 'I Will Teach You To Be Rich' Should be Required Reading - I didn't like this book - I loved it. I hardly love anything and find most books covering finances and 'how to be better off' to usually be a bit contrived and poorly written. They hype complicated methods that are guaranteed to get results and it doesn't seem to apply to those who aren't making a lot of money. That's not the case for 'I Will Teach You to be Rich'. Sethi has written a book that not only offers great advice for people of every income level but he seems to crafted a book on finances and improving your condition that goes against the usual recommendations and advice you get from financial experts and gurus. As a young adult who is pretty early in his career and who is interested in investing in his future, this book was perfect for me. This book covers it all - from looking at your monthly expenses and creating a spending/allocation plan, investing and tons of more. The Good: This book covers a lot ground in a short amount of pages. Unlike a lot of books, I liked that Sethi didn't waste time or pages repeating himself. From the first chapter, he hits the ground running and does a great job of describing his plan to make you rich. His plan really isn't a gimmick or ridiculous because it's basically all about educating you about how to manage your money, showing and describing how to do it and then giving you steps and a plan to actually get it done. Even though I'd heard of some of the things he mentioned in the book (Roth IRAs, high yield savings accounts, 401(k)), he explained each a step further than anybody or piece of literature I've heard before. I liked that the book is structured in a way to really take you from knowing little about managing your money to leaving you feeling more confident and inspired to get your financial life in order. By following his simple suggestions, I took a hard look at my own budget and where my money goes and managed to restructure my spending habits so that I will (hopefully) manage to save twice as much as planned, start investing and start aggressively paying down my student loan debts - all on my salary which isn't by any means huge. That's what I liked about the book - it was written more so for those with time on their side who are younger and haven't made too many mistakes. Yes, if you're 30 and older, you can still pick up this book and get some great advice but I feel some of the advice and tips offered would be scoffed at by older readers while younger ones would be more willing and inclined to follow Ramit Sethi's advice. The Bad: There really isn't much to complain about. His snarky/casual tone throughout the book can be a bit annoying or eye-roll inducing (he takes on the tone of a frat guy at times with countless references to hot babes and dining at Taco Bell), but once you get into the book, you get used to his style and look past this annoyance. As I said, I felt the book was written more for those in their 20s and early 30s than the older crowd. This isn't necessarily bad but I think an older audience isn't going to like some of his advice. Some may take it as being overly frugal and being young and a bit foolish (such as his statement about how investing in real estate or buying a house is a bit of an old school, outdated, belief). I'd caution some readers that this isn't for the financial faint of heart - there's a lot of great advice offered but if you read this with the belief that you're an expert or have little room for improvement, you're not going to get much out of this book and will argue with him in each chapter. In all, if you're looking for a book that's all about getting your financial life in order, this book is for you. The book covers a variety of topics including (but not limited to) investing, savings accounts, restructuring your spending habits to save for things you want to buy or enjoy, how to negotiate a raise, getting a deal on a new car, then really, you should pick up this book. It was very easy to get through but far more informative than most finance 'get rich' books out there on the market. A must-read for anyone serious about their money.

| Best Sellers Rank | #94,585 in Books ( See Top 100 in Books ) #964 in Personal Finance (Books) |

| Customer Reviews | 4.5 4.5 out of 5 stars (4,479) |

| Dimensions | 6 x 0.62 x 9 inches |

| Edition | 1st |

| ISBN-10 | 0761147489 |

| ISBN-13 | 978-0761147480 |

| Item Weight | 12.8 ounces |

| Language | English |

| Print length | 272 pages |

| Publication date | March 23, 2009 |

| Publisher | Workman Publishing |

S**O

A Great Personal Finance Book

I find it surprising that many other reviewers gave this book a lower rating because of its title. This book doesn't claim to be anything other than a personal finance book, and getting your personal finances in order and having the proper framework for thinking about finances is the first step to accumulating wealth. I'm reading Orman's "Young, Broke, and Fabulous" right now for example, and this book is MUCH better. Here's why its different: 1) Its organization is well thought out. The author lays out that the steps in a clear manner how one might TRANSITION from being somewhat disorganized about finances to being extremely efficient. The book is structured to tackle bank accounts and credit cards first, then moves to setting up the retirement accounts, then automating the payments of expenses and routing money to retirement accounts, and finally tackles investing and setting aside money for the big ticket purchases. 2) The content of the individual sections is of extremely high quality. What do I mean by this? In the bank account section Sethi suggests moving to an interest checking account (many checking accounts don't pay you interest). He suggests moving savings to an online savings account that offers a high interest rate (double to triple what I got at Citibank). He also suggests keeping no more than is absolutely necessary in the checking account, so as to maximize the high interest savings account. For me personally, I used to keep large amounts in my checking to avoid Citibank's fees (which I also found out would be waived at many other banks). Basically through a few changes with my accounts, I'll probably be making hundreds of dollars this year on interest. As the balances within the accounts grow, that will change to thousands more on interest. This sort of extremely good, specific, actionable advice is sprinkled all over the book. The credit card section also has a lot of great actionable advice on simple ways to improve your FICO score. 3) In addition to teaching you how to save money, the book also teaches you how to save TIME. A huge part of this book teaches you a method for automating your accounts so that your money gets routed to retirement accounts, savings accounts, and paying bills and credit cards flawlessly on time, without any effort on your part. This is probably the most useful section of the entire book. I've definitely wasted a lot of time in the past individually mailing checks, and then later individually paying bills online... The system as a whole is powerful, and will save me time as I begin to implement it. ***My one criticism of this book is the section on investing. While I think Sethi is correct about everything else in the book, he is wrong to tell individuals never to pick their own stocks. His advice on index funds and lifecycle funds is good for most people, but its not good for everyone. Some people SHOULD pick their own stocks. I also don't agree with Sethi's take on asset allocation. He suggests that an investor should begin shifting from stocks to bonds as he/she gets older. I personally believe that bonds should be bought or sold depending on whether stocks are in a bull market or bear market cycle. Despite these investing criticisms, I still gave this book 5 stars, because for 80% of people it doesn't matter. They SHOULD just stick their money in index funds or lifecycle funds. The other 20% of people who want to pick stocks would be well served by reading a book devoted solely to investing. If you are interested in picking stocks, read The Intelligent Investor by Ben Graham. Its the single greatest book on investing, as stated by Warren Buffet.

A**D

'I Will Teach You To Be Rich' Should be Required Reading

I didn't like this book - I loved it. I hardly love anything and find most books covering finances and 'how to be better off' to usually be a bit contrived and poorly written. They hype complicated methods that are guaranteed to get results and it doesn't seem to apply to those who aren't making a lot of money. That's not the case for 'I Will Teach You to be Rich'. Sethi has written a book that not only offers great advice for people of every income level but he seems to crafted a book on finances and improving your condition that goes against the usual recommendations and advice you get from financial experts and gurus. As a young adult who is pretty early in his career and who is interested in investing in his future, this book was perfect for me. This book covers it all - from looking at your monthly expenses and creating a spending/allocation plan, investing and tons of more. The Good: This book covers a lot ground in a short amount of pages. Unlike a lot of books, I liked that Sethi didn't waste time or pages repeating himself. From the first chapter, he hits the ground running and does a great job of describing his plan to make you rich. His plan really isn't a gimmick or ridiculous because it's basically all about educating you about how to manage your money, showing and describing how to do it and then giving you steps and a plan to actually get it done. Even though I'd heard of some of the things he mentioned in the book (Roth IRAs, high yield savings accounts, 401(k)), he explained each a step further than anybody or piece of literature I've heard before. I liked that the book is structured in a way to really take you from knowing little about managing your money to leaving you feeling more confident and inspired to get your financial life in order. By following his simple suggestions, I took a hard look at my own budget and where my money goes and managed to restructure my spending habits so that I will (hopefully) manage to save twice as much as planned, start investing and start aggressively paying down my student loan debts - all on my salary which isn't by any means huge. That's what I liked about the book - it was written more so for those with time on their side who are younger and haven't made too many mistakes. Yes, if you're 30 and older, you can still pick up this book and get some great advice but I feel some of the advice and tips offered would be scoffed at by older readers while younger ones would be more willing and inclined to follow Ramit Sethi's advice. The Bad: There really isn't much to complain about. His snarky/casual tone throughout the book can be a bit annoying or eye-roll inducing (he takes on the tone of a frat guy at times with countless references to hot babes and dining at Taco Bell), but once you get into the book, you get used to his style and look past this annoyance. As I said, I felt the book was written more for those in their 20s and early 30s than the older crowd. This isn't necessarily bad but I think an older audience isn't going to like some of his advice. Some may take it as being overly frugal and being young and a bit foolish (such as his statement about how investing in real estate or buying a house is a bit of an old school, outdated, belief). I'd caution some readers that this isn't for the financial faint of heart - there's a lot of great advice offered but if you read this with the belief that you're an expert or have little room for improvement, you're not going to get much out of this book and will argue with him in each chapter. In all, if you're looking for a book that's all about getting your financial life in order, this book is for you. The book covers a variety of topics including (but not limited to) investing, savings accounts, restructuring your spending habits to save for things you want to buy or enjoy, how to negotiate a raise, getting a deal on a new car, then really, you should pick up this book. It was very easy to get through but far more informative than most finance 'get rich' books out there on the market. A must-read for anyone serious about their money.

S**L

I kept putting off buying this book because, as so many people do, money, planning and investing is "I have time, I'll figure it out later". One night at 2am I was watching Ramit's videos on negotiation due to an impending job discussion I would be having as I start my career after transitioning from Grad School. I bit the bullet and bought the book, which incidentally is extremely cheap. His advice is extremely well written, it is funny and enjoyable to read. He tackles the root causes of peoples inaction and attitudes towards money. In this book, his key principals are to automate your money flow so your saving, investing, retirement all happens on its own and you don't see it. He also teaches to spend extravogantly on the things you love, and cut mercilessly on things you don't. When he says "teach you to be RICH" he doesn't just mean in the monetary sense, he means lead a rich life as well. Sure you can make a tiny bit more money by being painfully frugal, but you won't be happy. If you are in your twenties or early thirties this is an essential book. It's delightful to read, contrary to what you'd think a finance book would be, and contains extremely useful, practical, and easy to implement advice. He also discusses how to approach big money decisions and save tons of money on cars, homes, and weddings. There is even advice on dealing with family and having the money talk with a significant other. It's a six week "course" but really it just breaks down the tasks into manageable bites. You could implement all of his advice within a few weeks without issue if you are in a good position already. Note, if you are in your forties or fifties, not all of this is targeted at you, however if you feel the need to have money advice it would still be extremely useful to see the money automation, debt management, etc. Just know going in that you aren't the target audience and take it with a grain of salt. In closing, don't delay, Under 20 dollars will pay for itself hundreds of times over compared to continuing to coast along for years.

Y**O

⭐️⭐️⭐️⭐️⭐️ (5/5) „I Will Teach You to Be Rich“ – modernes Handbuch für persönliche Finanzen, praxisnah und direkt 📌 Kurzfazit Ramit Sethi vermittelt in seinem Buch einen systematischen, pragmatischen Ansatz zum Umgang mit Geld: von Kontostruktur, Schuldenabbau und Investitionen bis hin zu psychologischen Barrieren. Anders als viele klassische Finanzbücher ist es sehr hands-on, humorvoll und auf junge Berufstätige zugeschnitten. 📚 Inhalt in Kürze Automatisierung von Finanzen (Daueraufträge, Kontensysteme) Schulden tilgen und Kreditkarten verantwortungsvoll nutzen Frühzeitig in Indexfonds investieren Verhandeln lernen (z. B. bei Gehalt, Gebühren, Fixkosten) Fokus auf „Big Wins“ statt auf kleine Verzichtsstrategien (Latte-Debatte) Psychologie des Geldes: Überwindung von Aufschieberitis und Geldängsten 🔬 Wissenschaftliche Relevanz Stärken: Deckt viele Kernideen der Behavioral Finance ab (Automatisierung, Defaults, Mental Accounting). Seine Ratschläge zur passiven Geldanlage (Indexfonds, langfristig) sind empirisch durch moderne Finanzforschung gestützt (vgl. Fama/French, Vanguard-Studien). Schwächen: Stark US-zentriert (Kontosystem, Kreditkarten, Investmentprodukte). Kein tiefes Finanzlehrbuch, sondern praxisnaher Ratgeber. 👉 Fazit Wissenschaft: Methodisch solide, viele Empfehlungen sind mit moderner Finanzforschung vereinbar, aber eher praxisnah als akademisch. 🌍 Kulturelle Relevanz Hat eine ganze Generation von Millennials für persönliche Finanzen sensibilisiert. Besonders durch Sethi’s Blog und Podcast als „Finanzcoach für junge Leute“ einflussreich. Teil der „New Wave“ der Finanzliteratur – weniger trocken, mehr direkt und alltagsnah. Kulturell bedeutsam, weil es Finanzwissen populär macht und Barrieren abbaut. 💭 Meine persönliche Meinung Positiv: Sehr praxisnah, direkt, ohne unnötigen Jargon. Man kann sofort Maßnahmen umsetzen. Kritisch: Wer tiefe Investmenttheorie sucht, wird es zu oberflächlich finden. Für Nicht-US-Leser ist nicht jedes Beispiel übertragbar. Für mich: eines der besten Einsteigerbücher in die Welt der Finanzen, weil es Psychologie und Praxis verbindet. 🎯 Fazit I Will Teach You to Be Rich ist ein hochwirksamer Finanzratgeber, der klug, humorvoll und praxisnah geschrieben ist. Wissenschaftlich solide im Kern, kulturell relevant als Generationenbuch. ⭐️⭐️⭐️⭐️⭐️ – 5 von 5 Sternen Weil: klar, umsetzbar, wissenschaftlich fundiert und kulturell einflussreich.

A**E

Me gustan los sistemas que propone Ramit, no todos son aplicables a todos los países y servicios financieros, pero son muy útiles. Soy fan.

P**R

I bought first edition to see what it says about managing finance in 2008 time. This book is simple and crisp to the point. Not much technical jargons like other books and clearly shows how to achieve more with what you’ve. I’m impressed with this book and will give a shot for next one. Thanks and All the best Ramiti 👍🏻

A**A

I loved this book! Really practical step by step advices that you can incorporate into your life! I would recommend it definitely!

Trustpilot

1 month ago

5 days ago